Established in 2016, Fengate Private Equity is a Toronto-based investment platform focused on partnering with growth-oriented businesses in the business services and industrials, healthcare, and consumer products and services sectors. With more than $700M in assets under management, our mission is to partner with entrepreneurs to help them realize their growth ambitions and drive lasting positive change in their businesses – an approach we describe as providing Transformative Capital.

With a 50-year entrepreneurial history, we understand the challenges presented with scaling a business. Our Transformative Capital approach was designed to help our partners elevate their businesses’ trajectory by navigating the challenges and opportunities presented through growth.

Strong Partnerships

Building partnerships is at the centre of what we do. Rooted in our core values of Alignment, Transparency and Trust, our active partnership approach sets the foundation required to adapt to the evolving demands of scaling a business.

Customized Solutions

Our approach combines bespoke financial solutions suited to the needs of our partners while leveraging our experience and resources to anticipate and navigate the obstacles presented through growth.

Institutional Scale

With more than $9B+ AUM and 230 employees, the Fengate platform provides extensive network, corporate resources, and capabilities delivering institutional scale and differentiated success for our partners beyond traditional private equity firms.

Our Transformative Capital has helped create significant value for our portfolio companies by helping our entrepreneurial partners accelerate the evolution of their businesses. We create value through our 3 Step Value Creation process:

Strengthen the Foundation

Strengthen the Foundation

All great businesses need a strong foundation. Through joint planning and collaboration, we work with our partners to ensure appropriate investment is made in the systems, processes and people required for the future.

Build to Scale

Build to Scale

With a strong foundation set, our focus shifts to building scale. However, not all growth is created equal. Through our strategic guidance and leveraging the Fengate network, we help our partners to identify and execute on accretive growth opportunities.

Continuously Improve

Continuously Improve

Continuous improvement is at the heart of our Fengate culture. We seek to combine our collective talents with our partners to create a powerful engine driving continuous improvement by evaluating and experimenting with new ways to create value and opportunities for the business, its employees and communities.

Hear From Our Partners

We seek to identify scalable platforms led by high-quality entrepreneurs and management teams in the expansionary stage of their business.

Financial Criteria

Investment: $25M to $50M

EBITDA: up to $30M

Sector Focus

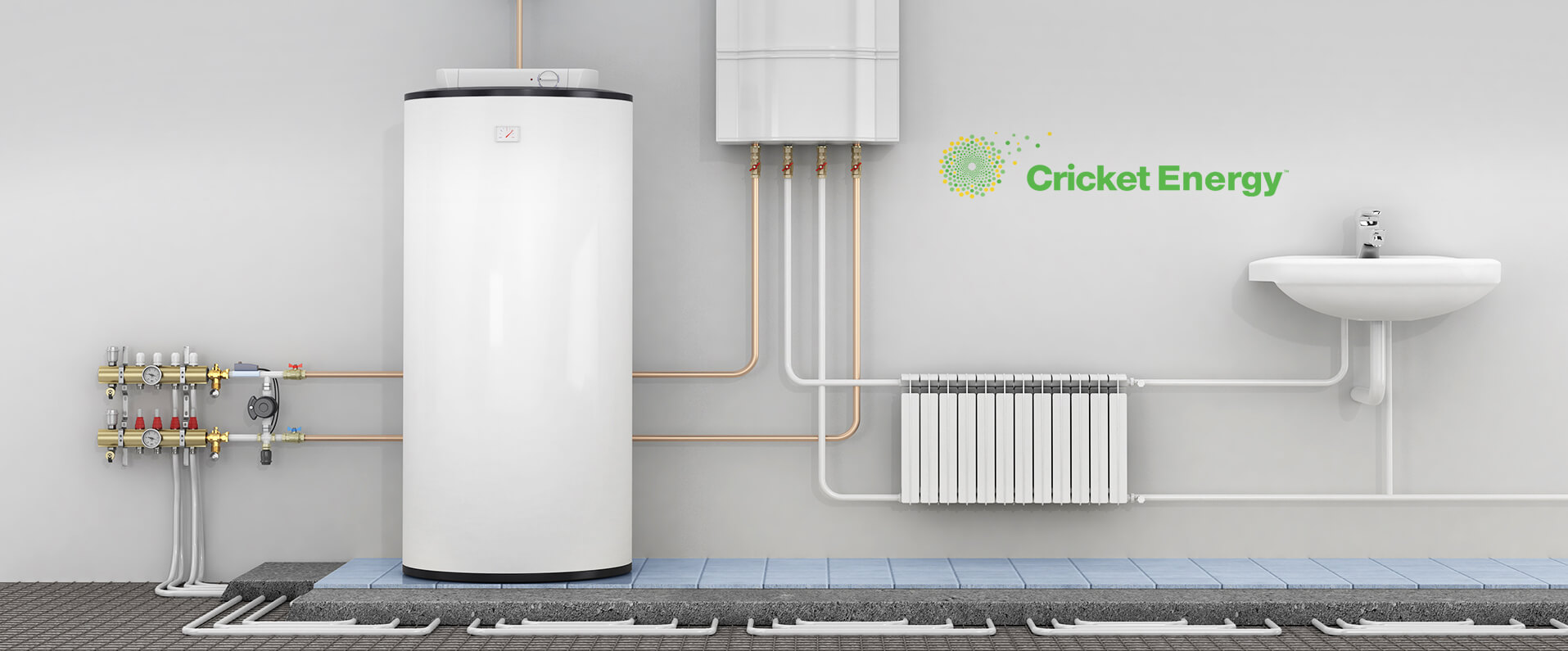

Business Services and Industrials

Healthcare

Consumer Products and Services

Ownership

Influential Equity Positions

(30% to 80% ownership)

Geography

North America

Capital Structure

Common Equity

Preferred Equity

Structured Equity

Capital Uses

Primary Capital

Secondary Capital (Liquidity Solutions)

At Fengate, we understand that growing our communities is fundamental to our work. Our commitment to environmental sustainability, social responsibility and corporate governance defines great stewardship across our firm, our stakeholders and their property investments, and the communities we work in, creating the foundation for better informed decisions for the long-term horizon.