George Theodoropoulos,

Managing Partner

Over the past 12 months we have experienced ongoing economic turbulence, and while infrastructure is seen as better able to withstand such pressures than other asset classes, investors still face the impact of rising interest rates, volatile public equity markets and the looming threat of recession.

Tailwinds for North American Infrastructure

Notwithstanding this turbulence, in our opinion there are three macro forces at play today that make North America one of the most attractive infrastructure markets in the world. These are:

- Geopolitics and their effect on global capital flows

- Economic stability from positive demographics and government policies

- Inflation, interest rates and asset values.

Let us start with geopolitics. Geopolitical conflict and instability – Ukraine-Russia and the recent conflict in the Middle East – is currently showing up through capital moving to safer jurisdictions, namely the United States (U.S.) and Canada, as it seeks political, economic and currency stability.

As interest rates rise, many expect a recession will materialize in the U.S. and Canada. But there are two major factors helping these two economies stay out of recession.

The first is demographics. Although Canada is experiencing similarly low birth rates as its peer economies, it has tremendous immigration. With respect to the U.S., birth rates are higher than most of its peer economies and immigration continues to be stable. Simply put, both Canada and the U.S. are experiencing stronger population growth relative to other developed economies.

The second factor is U.S. government industrial policy aiming to de-carbonize the local economy, improve infrastructure and support on-shore strategic manufacturing.

Enacted by the U.S. in 2022, the Inflation Reduction Act became the most significant piece of legislation for climate action in history, allocating $385 billion to energy and climate spending. The U.S. federal government’s goal is to reduce net greenhouse gas emissions by 50 – 52% below 2005 levels by year 2030. It is an impactful piece of legislation that will drive significant growth in energy transition projects for the next 10 to 15 years.

The year 2022 was significant for the infrastructure sector, with the U.S. federal government also passing the Infrastructure Investment and Jobs Act (IIJA), commonly referred to as the Bipartisan Infrastructure Law. The IIJA will provide more than a trillion dollars in federal funding for infrastructure over five years, of which $550 billion is new funding, touching everything from bridges and roads to the nation’s broadband, water and energy systems. The spending will come in the form of grants and subsidies to states and local authorities.

Today, we are observing a steady flow of greenfield transportation and social infrastructure projects in the U.S. and Canada. Fengate is actively bidding on five availability-based, public-private partnership projects, and is tracking another 10.

Last, the U.S. government’s policy to on-shore key, strategic manufacturing. In 2021, the federal government committed to fortifying the nation’s critical supply chains to boost local manufacturing. A perfect example is advanced computer chips. The U.S. has invested billions to enhance the on-shore production of semiconductors.

These government policies, coupled with population growth, provide a strong foundation for North American infrastructure investing throughout the next 10 years.

Finally, let’s discuss inflation. For the first time in decades, inflation has returned as a serious problem in developed markets. In response, the cost of capital is rising around the world.

After stubbornly stable infrastructure asset valuation in the first half of 2023, we are seeing an increase in equity discount rates, resulting in lower asset values for core infrastructure in the U.S. and Canada. The primary reason for this is that 10-year and 30-year U.S. Treasury rates have climbed to over 4.5%, resulting in investment grade infrastructure debt being issued at over 6%. We have observed a 1% to 2% increase in equity discount since the start of this year, with most of that increase occurring in the past three months.

Remember, one of the main narratives around infrastructure for the past decade went something like this: in a never-ending period of low interest rates, investors unable to get yield from fixed income turn to infrastructure as the alternative, with its low-risk profile and stable, long-term cash flows. For obvious reasons this narrative no longer holds. Today we are dusting off an older narrative. I am referring to infrastructure’s inflation-hedging abilities. Infrastructure’s inflation-fighting superpowers are now the new selling feature in our high inflationary environment.

This, combined with the recent increase in equity returns, we are observing very attractive investment opportunities in the U.S. and Canada, especially with respect to greenfield, mid-market assets with returns strongly correlated to inflation.

A New Era for Infrastructure Investments

Meanwhile, there are deeper, more gradual ways in which the asset class is changing. For example, transformations in energy production, human mobility and artificial intelligence are introducing new forces to existing investments and testing their resilience. We have entered into a new era for infrastructure investing.

Some investments viewed as low-risk, low-return ‘super core’ may carry more risk than is currently understood, particularly as certain fuel sources and corresponding assets are phased out of the economy. On the other hand, maturing technology, combined with large-scale social changes, such as remote work, have moved digital assets down the risk spectrum.

This shake-up and the unpredictable pace at which energy transition is unfolding necessitate investors to review their existing portfolios to ensure assets are correctly rated for risk. The days of sitting back and enjoying predictable, long-term yields are gone. The changing environment requires investors to be more proactive about asset management, constantly revisiting the risks and returns on their investments to ensure that they have a current understanding of value drivers and trends.

At the same time, these economic and social transformations are introducing new types of investments. I call these ‘next-generation’ infrastructure assets. Think investments in electric-vehicle charging networks, hydrogen production and distribution systems, fibre-to-the-home businesses, satellite and 5G telecom networks, to name a few. These assets promise to offer characteristics that infrastructure investors look for – long useful lives, high barriers to entry, monopolistic market positioning and generally stable usage and stable cash yields.

But are all these next-generation assets proven infrastructure investments? In other words, do they have a history of performance that investors can rely on? When is the asset ready for commercial and consumer adoption? Is the technology resilient to alternatives? What are the revenue drivers? Are long-term contracts available? How does one access these assets – through a business platform, or stand-alone projects? In short, are these assets ready to be classified as infrastructure investments?

For us, it’s a question of historical track record. By definition, next-generation assets have little to no historical data for us to cite, and fund managers have relatively lower experience working with them. When does an asset have sufficient history to be ‘infrastructure investment’ worthy? If you struggle to answer this question, then perhaps you may have already answered it.

As we all know, we are contending with rising interest rates. Investors no longer benefit from the tail winds of decreasing capital pricing to cover up their shortcomings. There is nowhere to hide. Fund managers must create value to earn their bonuses. Without a sound strategy, the discipline to stick to this strategy, and the capabilities and experience to execute, I suspect some managers will jump into unproven assets, which means higher risk for investors.

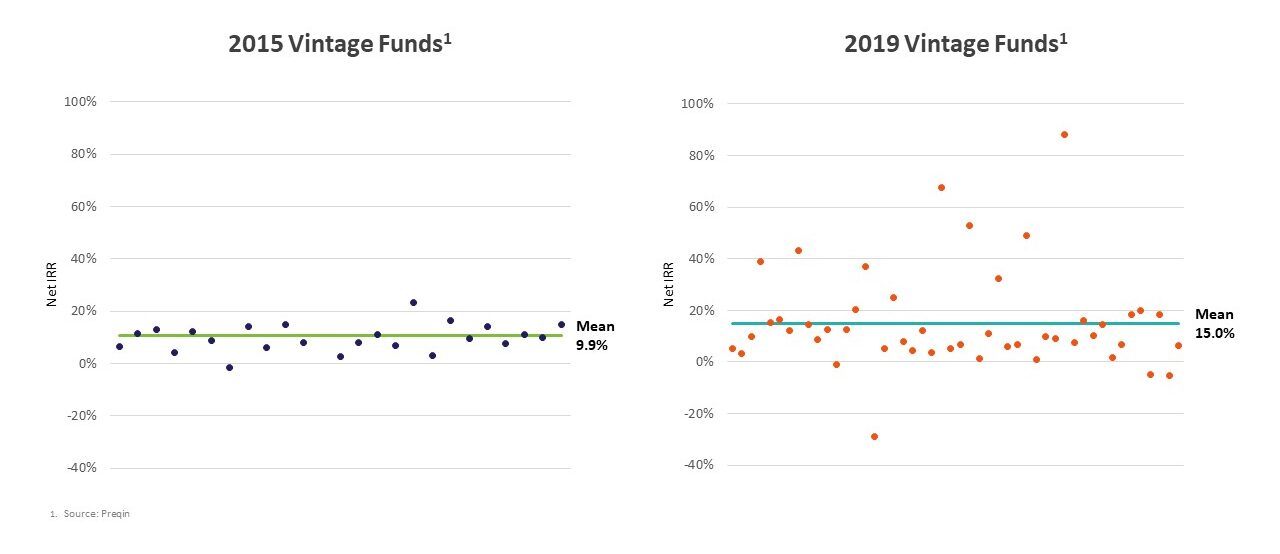

Variability of an asset’s equity return should be within a narrow band over an asset’s life. As you can see in the table below, performance variability has significantly increased when comparing infrastructure funds in years 2015 versus 2019. I wish there was more recent data to show you, as I suspect that this variability continues to trend upwards.

In pursuit of higher returns, our view is that early investors into next-generation infrastructure will have to accept significant development, technology and commercialization risk, including relatively long periods of negative cash flows.

We have observed core and core-plus managers moving into these next-generation assets. I believe the variability of infrastructure fund manager performance will significantly increase in the next 10 years.

In contrast, Fengate’s approach is to continue its proven and successful investment strategy, employed since 2006, with a greater focus on creating value through the development and construction of proven infrastructure assets. We call this strategy ‘build-to-core’. We will continue to invest in sectors such as transportation and social public-private partnerships, solar and wind power projects, battery storage and wireless communication towers in Canada and the U.S., where we have and will continue to create value for investors.

Let’s be clear – this requires expertise and experience. Fengate employs an active approach to asset management leveraging its value creation and asset management team, which is comprised of more than 40 professionals with extensive experience and technical expertise in engineering, construction and operations.

In an environment of significant transformational change, rising cost of capital, and economic uncertainty, I believe a greater focus on value creation through the development of proven infrastructure assets offers superior risk adjusted returns, relative to next-generation infrastructure assets.

While Fengate continuously monitors and reassesses the opportunities available to it, we remain focused on value creation through active management in proven infrastructure investments, aspiring to deliver long-term value and accretive returns to our investors.