Fengate has grown to become a market leader, driven by a focus on relationships, the pursuit of excellence, and visionary leadership.

1974

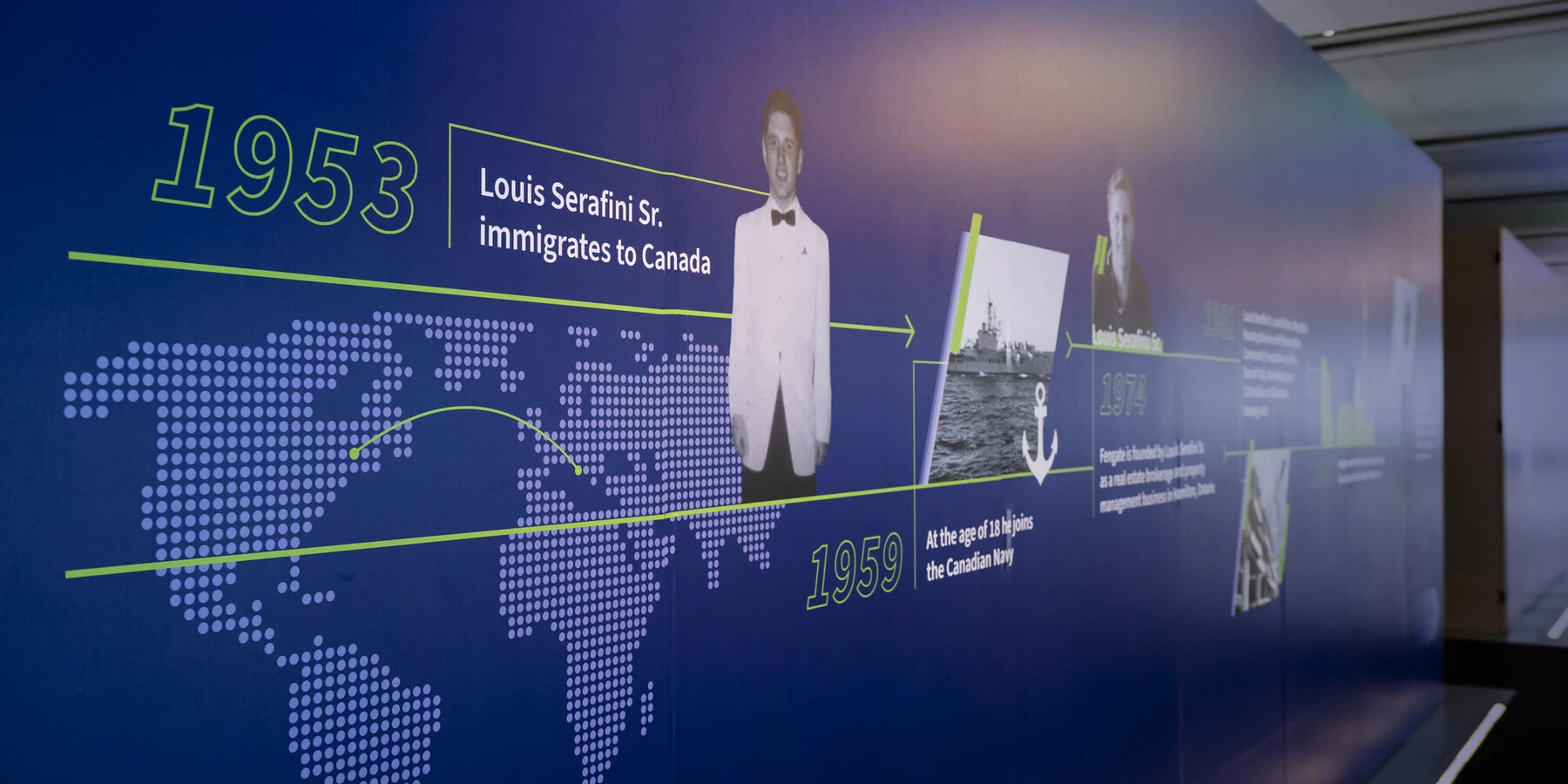

Fengate is founded by Louis Serafini Sr. as a real estate brokerage and property management business in Hamilton, Ontario.

1981

The Fengate-LiUNA partnership was established when Enrico Mancinelli of LiUNA local 873 entrusted Louis Serafini Sr. to manage their initiative to develop affordable housing in Hamilton, Burlington, and Niagara Falls.

1995

Fengate makes the decision to concentrate its business in the Greater Toronto Area.

2000

Fengate launches Northgate Properties Inc., its first fund, investing in real estate on behalf of a group of high-net-worth investors.

2005

Fengate appoints Lou Serafini Jr. as President and CEO.

LPF Realty Inc. launches.

2006

Fengate establishes LPF Infrastructure Fund LP, the firm’s first infrastructure fund.

2009

Fengate begins expanding its investor base by adding a dozen new clients.

2010

The Fengate Community Foundation, a $2+ million grant, is created in support of local charitable organizations.

2011

Fengate establishes a presence in Vancouver, British Columbia.

2015

Fengate opens an office in Oakville, Ontario.

2016

Fengate opens its main investment office in Toronto’s TD Centre.

2017

Fengate Private Equity is launched.

Fengate opens its first U.S. office, located in Houston, Texas.

2019

Fengate exceeds its fundraising target and closes Fengate Core Infrastructure Fund III with $1.1 billion USD in capital commitments.

2019

Fengate’s investor base continues to grow, as does its strategy in launching new products.

Fengate Infrastructure Yield Fund launches.

2021

Fengate Core Infrastructure Fund III is fully deployed, and Fengate Infrastructure Fund IV launches.

2022

Fengate Real Estate expands its portfolio, creating new products including the Fengate Multifamily Income Fund.

Fengate launches LPF Ventures Fund.

2023

Fengate Private Equity and Weathervane Investments announce the acquisition of Saco Foods, the first U.S. platform investment in PE.

Fengate Infrastructure closes a record $1.8 billion transaction for a majority stake in eStruxture Data Centers, Canada's largest data center platform.

2024

Fengate Infrastructure Fund IV closes at $1.1 billion USD.

2025

Fengate opens its second U.S. office in Miami, Florida.

Fengate breaks ground on five residential developments, bringing 1,900+ rental units to market.